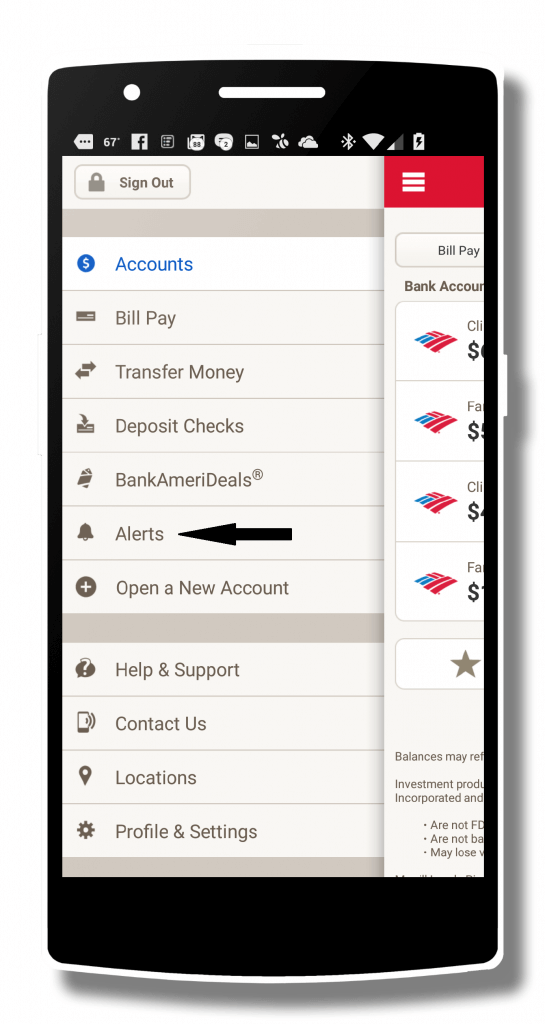

Here are advantages online banks offer that can improve your financial life. Many also offer access to surcharge-free ATM networks. Generally, online banks offer the ability to open accounts, pay bills, transfer funds, deposit checks, view statements and carry out other typical banking tasks. Online banking products and services vary by institution. They also can link online bank accounts with accounts they have at traditional banks, credit unions or other online banks. How Does Online Banking Work?Ĭustomers of online banks can initiate transactions online, through a mobile app, by phone or by mail. The difference is that with traditional banking, you also have the option of visiting a branch. The range of services available usually doesn’t differ that much from what you’d find at the best online banks. Most traditional banks and credit unions offer online banking services to their customers. Rather than going to a branch or ATM to manage your money, you can do so via your laptop or smartphone. Online banking is banking conducted virtually, either through a website or mobile app. To learn more about our rating and review methodology and editorial process, check out our guide on How Forbes Advisor Reviews Banks. To appear on this list, the bank must be an online bank with national availability. Banks with high customer satisfaction and an intuitive digital banking experience also earned higher scores. Online banks offering the highest APYs and lowest fees across their products rose to the top of the list, as did those with a low minimum deposit and balance requirements and a broad ATM network.

Here’s the weighting assigned to each category: We ranked each bank on 12 data points within the categories of product offerings, APY, fees, ATM network, customer experience, digital experience and minimum requirements. To create this list, Forbes Advisor analyzed the products and services of 60 online banks, including a mix of large and small online banks and neobanks.

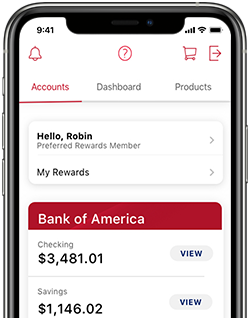

Bank of america online banking not working full#

Read our full Capital One 360 Bank Review. Physical locations aren’t something you’ll find with most online banks. If you can’t find a Café near you, Capital One also offers full-service branches in some states. Cafés offer certified money coaches, money workshops and assistance with opening and managing Capital One accounts. And Eno, the bank’s virtual assistant, is available in the mobile app or by text.Īt Capital One Cafés, you can get personal support in a coffee-shop atmosphere. You can access your accounts at any time from anywhere online or via the bank’s highly rated mobile app. None of the bank’s products require a minimum deposit or minimum balance. None of Capital One’s banking products require a minimum deposit or minimum balance.Ĭapital One 360 makes it easy to open and maintain your accounts-whether it’s a savings account, checking account or CD. In addition to 24/7 digital banking and live customer service seven days a week, Capital One offers full-service branches in some states, along with Capital One Cafés. We chose Capital One 360 as a top pick for the best online banks because it’s a unique hybrid of a no-monthly-fee online bank and a brick-and-mortar bank. You can also get your questions answered via live chat, email and regular mail.Īlly’s mobile app, available on iOS and Android, gets high scores in the App Store and Google Play. And the bank’s “surprise savings” feature analyzes your Ally checking account for money that’s safe to save and transfers it to your savings account automatically.Īlly Bank earns high customer satisfaction scores, with customer service available 24/7 by phone. The bank also has a “round ups” feature that transfers the spare change from your transactions into your savings account. With Ally’s savings account, you can create “buckets” that allow you to set 10 different savings goals within a single account.

It has an extensive ATM network and reimburses up to $10 per statement cycle for fees charged at out-of-network ATMs.Īlly customers also get access to the bank’s savings tools. As a full-service online bank, Ally offers an array of high-APY, low-fee checking and savings products. We chose Ally as one of the best online banks for its competitive rates, low minimum deposit requirements, unique online savings tools and lack of monthly maintenance fees.

0 kommentar(er)

0 kommentar(er)